English

Search

2025/05/16

- China and U.S. Announce Landmark Tariff Reductions Following Geneva Talks

May 13, 2025

In a historic move to de-escalate trade tensions, China and the United States jointly announced significant tariff reductions on May 12, 2025, following high-level economic talks in Geneva. The agreement, hailed as a "substantive breakthrough," marks the first major progress since the 2018 trade war and signals a potential thaw in bilateral relations.

Tariff Reductions:

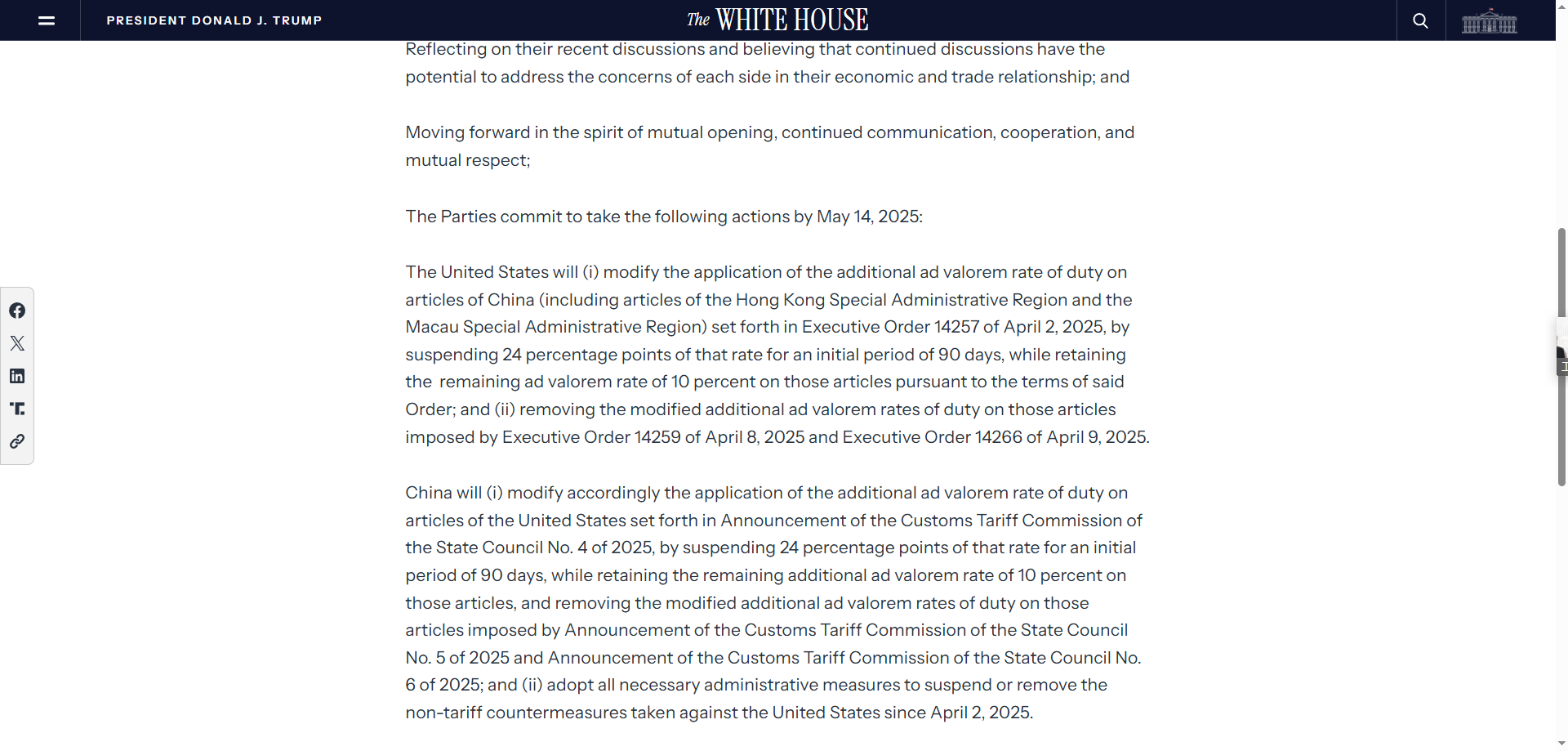

The U.S. committed to cancel 91% of tariffs imposed on Chinese goods under Executive Orders 14259 (April 8) and 14266 (April 9), while suspending 24% of tariffs for 90 days from the original 34% levied via Order 14257 (April 2). The remaining 10% tariffs will stay in place14.

China reciprocated by removing 91% of retaliatory tariffs on U.S. imports and suspending 24% of countermeasures, mirroring the U.S. approach. Non-tariff retaliatory measures, such as export controls, were also paused13.

Both nations agreed to establish a bilateral consultation framework, led by Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Scott Bassent and Trade Representative Jamison Greer. Talks will rotate between the two countries or a mutually agreed third party to address unresolved issues, including remaining tariffs, technology disputes, and supply chain security.

Global markets rallied on the news

Equities: The Shanghai Composite Index rose 0.82%, while the Dow Jones Industrial Average surged 1.4%. Hong Kong’s Hang Seng Index jumped 3%, led by tech and export-oriented sectors.

Currency and Commodities: The offshore yuan appreciated 1% against the dollar, and gold prices plummeted 3% as risk appetite revived.

Shipping: Container shipping rates for U.S.-bound routes spiked, with freight forwarders reporting a surge in client inquiries amid expectations of revived trade flows.

Supply Chain Relief: Industries like solar panels, semiconductors, and consumer electronics—previously battered by tariffs exceeding 100%—are poised to benefit. Chinese photovoltaic firms, for instance, may reconsider relocating production from Southeast Asia back home.

Strategic Reserves: The U.S. retains 10% tariffs as leverage for future talks, while China emphasized its control over rare earth exports, a critical component for American defense manufacturing.

Global Stability: Analysts noted the deal injects "much-needed certainty" into the world economy, though long-term challenges, such as tech decoupling and competing supply chain visions, persist.

The breakthrough followed weeks of escalating tensions. In April 2025, the U.S. had raised tariffs on Chinese goods to 125%, citing fentanyl concerns and launching a Section 301 investigation into China’s maritime industries. China retaliated with its own measures, including rare earth export controls.

While the 90-day tariff suspension offers a reprieve, experts caution that structural issues—like U.S. tech sanctions and China’s state-led industrial policies—remain unresolved. The window for further negotiations is narrow, with both sides under pressure to address the remaining 10% tariffs and deepen cooperation on issues like climate change and WTO reform

Current U.S.- China trade relations remain fraught with uncertainties. Based on existing conditions, Delivered Duty Paid (DDP) remains the optimal shipping solution.

#1. E-commerce Products (Non-Steel/Aluminum Goods):

Overall tariffs generally range between 33% and 70%.

#2. Steel and Aluminum Products:

Tariffs remain elevated at 55% to 85%.

For e-commerce sellers, tariffs continue to impose significant costs.

Current Market Practices for DDP Freight Forwarders (FFs):

#1. Most DDP FFs are offering 0.56/kg or 0.56/kg or 11.19/CBM refunds for goods already on the water.

#2. Exclusions for Cleared Shipments:

Goods that completed customs clearance prior to May 14 will not be eligible for tariff refunds.

#3. Steel/Aluminum Exemption:

Due to the previous exemption of steel/aluminum products from the 145% tariffs, industry consensus dictates that no DDP refunds will apply to in-transit steel/aluminum shipments.